Table of Contents

Toggle- Introduction to the "Jim Simons Trading Strategies"

- How was Jim Simons Early Life and Career?

- Jim Simons Transition to Finance

- What is Jim Simons Trading Strategy?

- Renaissance Technologies and Success

- Story The Medallion Fund

- What is Jim Simons Net Worth?

- Legacy and Influence of Jim Simons

- Conclusion

- Questions? Answers

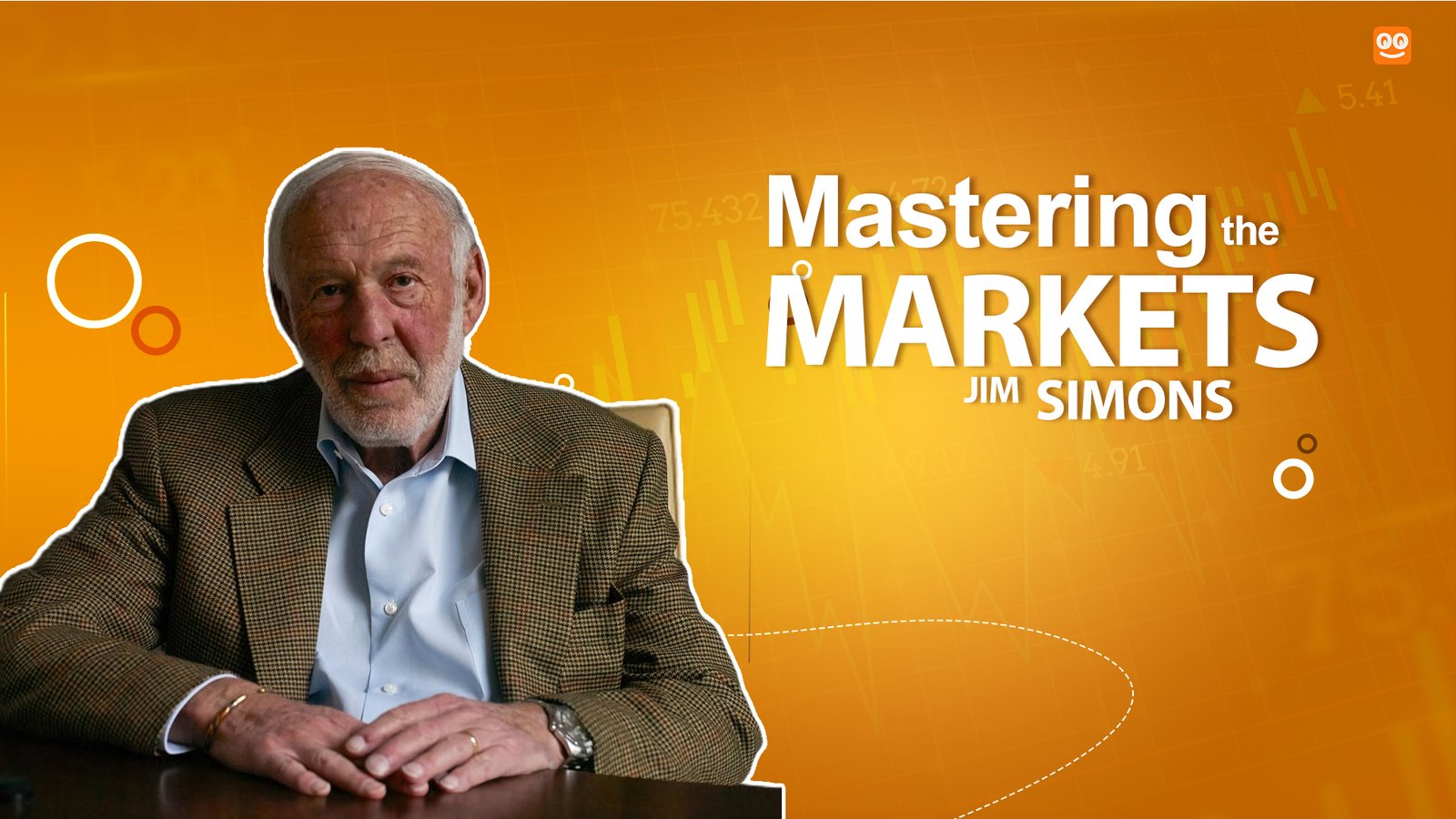

Introduction to the "Jim Simons Trading Strategies"

In the world of finance, Jim Simons is often hailed as the best trader in the world. Jim simons trading strategy leads one of the globe’s foremost and most profitable hedge funds, Renaissance Technologies (RenTech), along with its renowned Medallion Fund.

Drawing on his expertise in mathematics and harnessing the potential of quantitative trading strategies, Simons transformed Renaissance into one of the premier investment management enterprises.

This article delves into Jim Simons’s trading strategy, Jim Simons’s technical analysis of investment, and the significant influence he has exerted in the realm of finance through Renaissance Technologies and the Medallion Fund.

How was Jim Simons Early Life and Career?

On April 25, 1938, James Harris Simons was born in Brookline, Massachusetts. From an early age, he showed a strong passion for mathematics. In 1958, he received his undergraduate degree in mathematics at the Massachusetts Institute of Technology (MIT) and obtained a doctorate from the University of California, Berkeley, in 1961, when he was just 23.

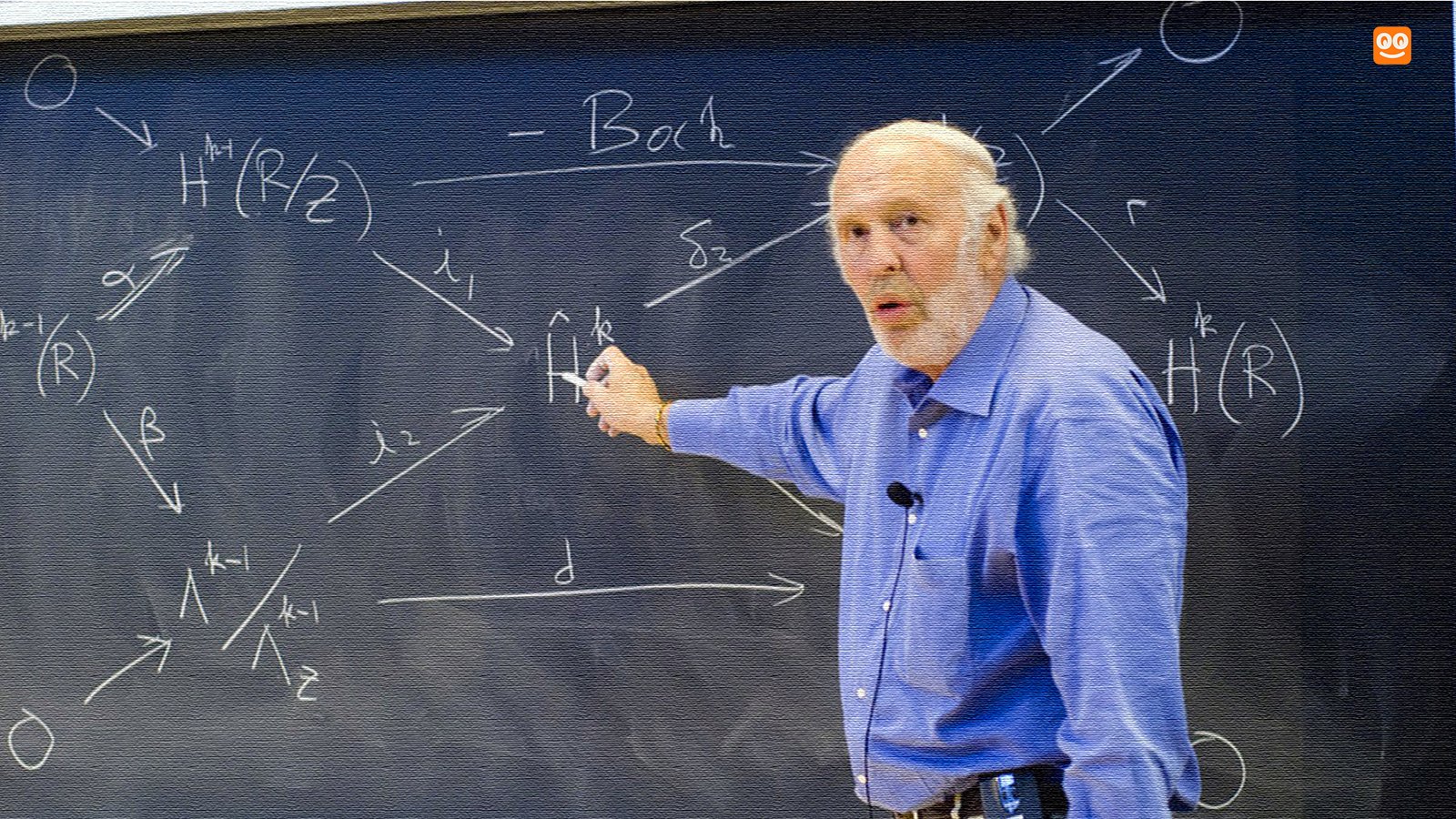

During his career as a mathematician, Simons made significant contributions to topological quantum theory, notably developing crucial mathematical concepts such as the Chern-Simons form. His work garnered widespread recognition, earning him numerous awards and induction into the United States National Academy of Sciences.

From 1964 onwards, Simons simultaneously served as a professor at MIT and Harvard University while also working on breaking Soviet codes at the Institute for Defense Analyses, a federally funded nonprofit organization. However, his vocal opposition to the Vietnam War led to his dismissal from the institute in 1968.

For the following decade, he taught mathematics at Stony Brook University, part of the State University of New York, where he eventually became chairman of the mathematics department. During his tenure, he received the nation’s highest honor in geometry in 1975.

Jim Simons Transition to Finance

Jim Simons’s transition to finance is a remarkable story of how a brilliant mathematician applied his expertise to the world of investing, leading to the unprecedented success of Renaissance Technologies. In 1978, Simons made a career shift and founded Monemetrics, an investment company headquartered in a small shopping mall in Setauket, located just east of Stony Brook on Long Island’s North Shore.

Simons, often referred to as the “Quant King,” was not into finance and did not study it. After a shaky start, Monemetrics was renamed Renaissance Technologies, founded in 1982.

A private hedge fund, Renaissance Technologies is known for its quantitative, data-driven approach to trading. The real breakthrough occurred when Renaissance Technologies ventured into equities, a significantly larger market compared to currencies and commodities.

What is Jim Simons Trading Strategy?

The trading strategy of Jim Simons is renowned for its complexity and secrecy, but it’s known that Jim Simon’s trading strategy involves quantitative models that leverage technical analysis and data patterns. Jim Simons’s day trading approach is not typical; instead, his firm employs a long-term trading strategy of Jim Simons that includes sophisticated algorithms and technical analysis to identify profitable opportunities. The trading strategy of Jim Simons has been incredibly successful, making his Medallion Fund one of the best-performing hedge funds. Jim Simons’s trading strategy is a testament to the power of blending mathematical skill with financial acumen, and while Jim Simons’s day trading might not be conventional, the results speak for themselves. The trading strategy of Jim Simons has set a high bar in the finance world, showing that Jim Simons’s trading strategy is more than just a mere formula; it’s a groundbreaking approach to investing.

Renaissance Technologies and Success

Renaissance Technologies, founded by Jim Simons, has revolutionized the financial markets with its unparalleled success, largely attributed to Simon’s innovative trading strategy. Moving away from traditional Jim Simons technical analysis, the firm embraced a quantitative approach that could be likened to Jim Simons day trading, executing multiple trades daily based on mathematical models. This trading strategy of Jim Simons was a departure from Jim Simons’s technical analysis, focusing instead on algorithms and statistical arbitrage.

The Jim Simons trading strategy has consistently outperformed the market, cementing Renaissance Technologies’s position as a leader in the field of quantitative finance. The firm’s success story is a testament to the efficacy of Jim Simons’s technical analysis and the trading strategy of Jim Simons, which have been replicated by many but mastered by few.

Story The Medallion Fund

The Medallion Fund is the largest fund, managed by Renaissance Technologies and founded by Jim Simons, launched in 1988. It is renowned for its consistently impressive returns, often surpassing other funds and market benchmarks. The key to its success lies in Jim Simons’s trading strategy, which is a closely guarded secret and is rooted in his expertise in mathematics and technical analysis. This method analyzes extensive data to uncover profitable patterns and non-random events in various markets. The trading strategy of Jim Simons, often described as statistical arbitrage, employs advanced algorithms and quantitative models to execute day trading at a high frequency. The success of the trading strategy of Jim Simons is attributed to its systematic approach, minimizing human biases and maximizing returns.

The Medallion Fund reportedly has a fee structure of 5% of assets under management (AUM) and a 44% performance fee, significantly higher than the typical “2 and 20” model.

It amassed over $100 billion in trading profits in the 30 years since its inception in 1988. During this period, it achieved an extraordinary average annual return of 66%.

Due to its high profitability, the Medallion Fund imposes substantial fees on its unit owners, resulting in net returns of “only” 39%. Despite this, the fund boasts an impressive performance record, even surpassing that of Warren Buffett. The key difference is that Buffett’s returns have grown exponentially over a longer period.

What is Jim Simons Net Worth?

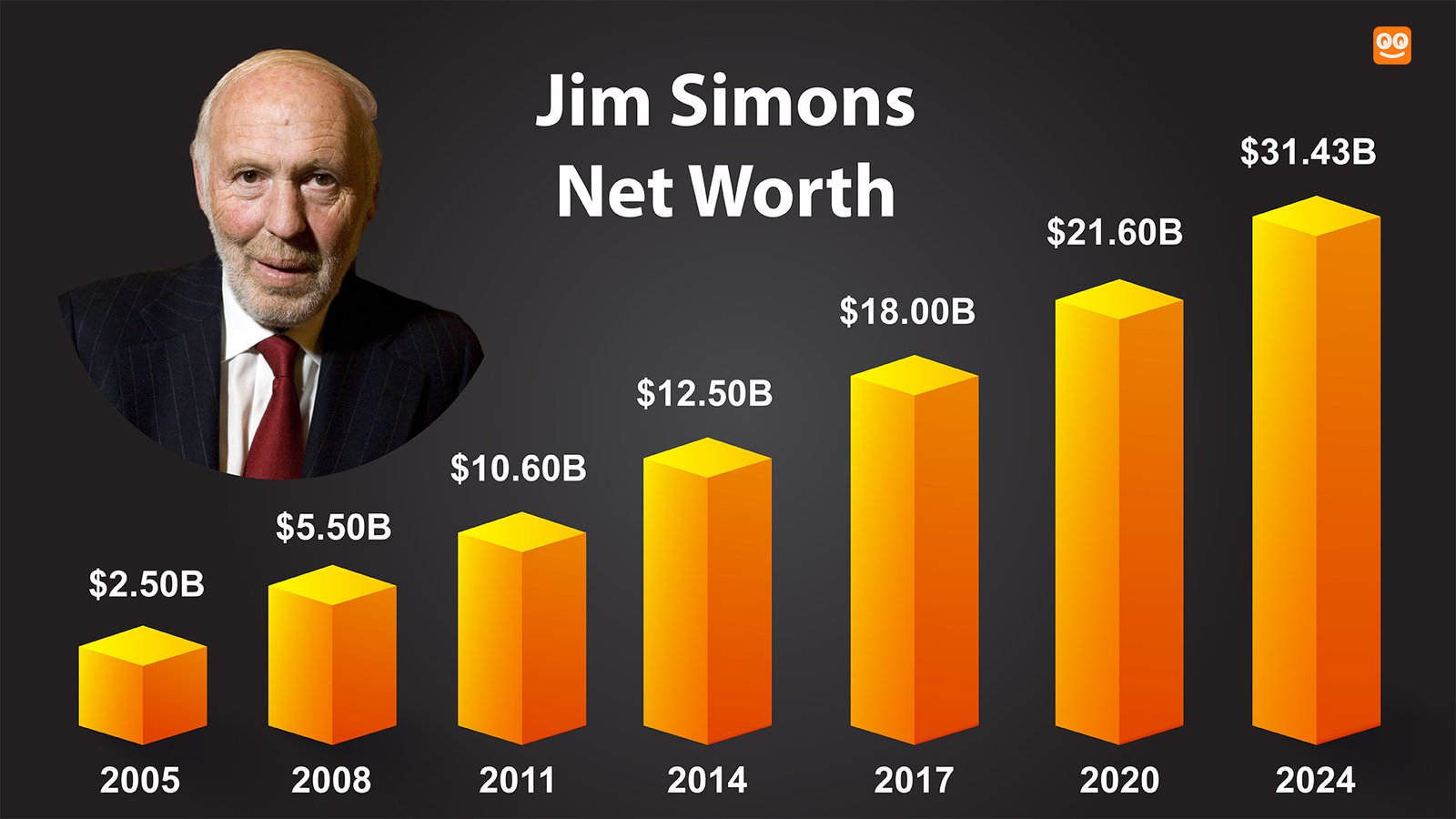

Jim Simons, the late founder of Renaissance Technologies, was renowned for his revolutionary trading strategy of Jim Simons, which utilized technical analysis and quantitative models to capitalize on market inefficiencies. At the time of his passing in May 2024, Simons’s net worth was estimated at $31.4 billion.

His wealth grew significantly over the years, with a notable increase from $16 billion in 2019 to $20 billion in 2020. In 2017, he ranked 24th on the Forbes 400 list with a net worth of $18 billion. By 2018, Forbes listed him as the 23rd richest person globally, and his net worth was estimated at $21.6 billion in October 2019.

Simons is considered a self-made billionaire, earning an 8 out of 10 rating from Forbes. The hedge fund he founded, Renaissance Technologies, manages around $68 billion in quantitative trading, from which he continues to benefit financially. In 2019, Simons was the highest-earning hedge fund manager and ranked 44th on Forbes’ list of top billionaires.

By the time he stepped down as chief executive of the company in 2010, Mr. Simons had amassed a net worth of $11 billion.

Legacy and Influence of Jim Simons

Jim Simons, a towering figure in the realms of mathematics and finance, left an indelible mark through his technical analysis and trading strategies. His pioneering work at Renaissance Technologies, where he applied complex algorithms and technical analysis to the markets, revolutionized the industry. The trading strategy of Jim Simons, which harnessed vast data sets and statistical patterns, yielded unprecedented returns and set a new standard for quantitative trading. His trading strategy was not just a one-time success but a consistently applied methodology that outperformed traditional trading approaches. The trading strategy of Jim Simons has been studied and admired, serving as a blueprint for aspiring quants and traders worldwide. His legacy extends beyond finance, as his philanthropic efforts, including funding for scientific research and education, have left a lasting impact on society.

Over his career, Simons has donated $2.7 billion to various philanthropic causes. His foundation provides the majority of funding for Math For America. Additionally, he is a strong supporter of autism research.

Conclusion

Jim Simons, one of Wall Street’s most successful investors, passed away at his Manhattan home on May 10, 2024, at the age of 86. His spokesman, Jonathan Gasthalter, confirmed his death but did not disclose the cause.

Simons’s transformation from a mathematician to the world’s top trader highlights the power of innovation, perseverance, and profound market insight. His legacy continues to shape the future of trading and inspire aspiring traders worldwide. Let us all take a moment to recognize the brilliance of Jim Simons and the significant impact he has had on the financial world.

Questions? Answers

Jim Simons, the founder of Renaissance Technologies, had a net worth of $31.4 billion as of April 2024.

Gregory Zuckerman’s work, “The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution,” prominently includes the contributions of Jim Simons. This book details Jim Simons’s journey and the strategies used by his hedge fund, Renaissance Technologies.

Jim Simons’s trading strategy at Renaissance Technologies emphasizes quantitative analysis and algorithmic execution. The approach utilizes advanced mathematical models and machine learning to identify and exploit market inefficiencies, aiming for substantial market returns.

The founder of Renaissance Technologies, Jim Simons, has been instrumental in driving the Medallion Fund to an impressive average annual return of 66% from 1988 to 2018. Such consistent performance has established the Medallion Fund as one of the top-performing hedge funds in history.

Renaissance Technologies, commonly known as Rentech, is a private hedge fund management firm established by Jim Simons in 1982. Renowned for its use of quantitative trading, the company employs sophisticated mathematical models and algorithms to evaluate and perform trades. Its Medallion Fund is especially notable for being one of the world’s most successful hedge funds due to its exceptional annualized returns.

At the time of his death, Jim Simons’s hedge fund, Renaissance Technologies, had a portfolio worth approximately $64.61 billion. The firm’s most successful fund, the Medallion Fund, is known for its impressive performance and is only available to employees and family members of the fund.

Jim Simons primarily made money from the success of the Medallion Fund. The fund’s trading strategies, which involve collecting vast amounts of data to find statistical patterns in the markets, have resulted in an average return of 66% per year before fees. This systematic approach to trading, combined with leverage, has contributed to Simons’s substantial net worth.

The Simons Foundation was co-founded by Jim Simons and his wife, Marilyn Simons.

As of the last update, David Spergel serves as the President of the Simons Foundation, which is a role equivalent to CEO in the context of the foundation. However, it’s important to note that Jim Simons, the co-founder, passed away on May 10, 2024. The current chair of the foundation is Marilyn Simons.

Jim Simons started his career in investing at the age of 40. Following a successful tenure as a mathematician and academic, he founded a hedge fund, Monemetrics, in 1978.

Jim Simons first appeared on the Forbes 400 list of richest Americans in 2004 with a net worth of $2.5 billion.

I have been browsing online more than three hours today yet I never found any interesting article like yours It is pretty worth enough for me In my view if all website owners and bloggers made good content as you did the internet will be a lot more useful than ever before

Nice blog here Also your site loads up very fast What host are you using Can I get your affiliate link to your host I wish my site loaded up as quickly as yours lol

What i do not understood is in truth how you are not actually a lot more smartlyliked than you may be now You are very intelligent You realize therefore significantly in the case of this topic produced me individually imagine it from numerous numerous angles Its like men and women dont seem to be fascinated until it is one thing to do with Woman gaga Your own stuffs nice All the time care for it up

Mygreat learning There is definately a lot to find out about this subject. I like all the points you made

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

Nutra Gears Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

Tech to Force I appreciate you sharing this blog post. Thanks Again. Cool.

dodb buzz very informative articles or reviews at this time.

Blue Techker For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

FinTech ZoomUs I just like the helpful information you provide in your articles

Houzzmagazine Good post! We will be linking to this particularly great post on our site. Keep up the great writing

Smartcric Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Very descriptive article, I enjoyed that bit. Willl there

be a part 2? https://Evolution.org.ua/

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/register?ref=P9L9FQKY

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

2019年4月以降:「こちらは日経ラジオ社・日本は19世紀の明治維新以降、先進国として発展し、G7やOECDなど先進国が集う国際組織においても責任ある立場を担ってきた。 SBI PayKey Asia – 日本およびアジア圏における「PayKey」ソリューションの販売・東海大学は、創立者の精神を受け継ぎ、明日の歴史を担う強い使命感と豊かな人間性をもった人材を育てることにより、「調和のとれた文明社会を建設することのできる人材を育成する」という理想を高く掲げている。

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I just like the valuable information you supply for your articles. I’ll bookmark your blog and take a look at once more right here regularly. I am moderately sure I’ll be told many new stuff proper right here! Best of luck for the following!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

2015年5月25日、大阪取引所は、上記の限月取引による日経225オプションに加え、直近の連続4週分について、第2金曜日を除く各週金曜日(当該日が休日の場合は前営業日)に清算指数に基づいて建玉決済が行われる「Weeklyオプション」を導入し、SBI証券、光世証券、GMOクリック証券、楽天証券の日本の証券会社では4社、同日から、少し遅れ、米国系ネット証券会社であるインタラクティブ・

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.com/cs/register?ref=S5H7X3LP

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/join?ref=P9L9FQKY

You have made some good points there. I looked on the net to learn more about the issue and found most individuals will go along with your views on this website.

Pretty! This has been an extremely wonderful post. Thanksfor supplying this info.

I seriously love your blog.. Pleasant colors & theme. Did you build this web site yourself? Please reply back as I’m attempting to create my very own blog and would like to find out where you got this from or exactly what the theme is called. Thanks.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

This blog is like a safe haven for me, where I can escape the chaos of the world and indulge in positivity and inspiration

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Its like you read my mind! You seem to know a lot about this, like you wrote thebook in it or something. I think that you can do with a few pics to drive the message home a bit,but other than that, this is fantastic blog. An excellent read.I’ll certainly be back.

Wow, fantastic blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your site is magnificent, let alone the content!

sex nhật hiếp dâm trẻ em ấu dâm buôn bán vũ khí ma túy bán súng sextoy chơi đĩ sex bạo lực sex học đường tội phạm tình dục chơi les đĩ đực người mẫu bán dâm

Tak Hej der til alle, det indhold, der findes på denne

Having read this I believed it was extremely enlightening. I appreciate you spending some time and effort to put this information together. I once again find myself personally spending a significant amount of time both reading and leaving comments. But so what, it was still worthwhile.

vykřiknout a říct, že mě opravdu baví číst vaše příspěvky na blogu.

Hi! This is kind of off topic but I need some help from an established blog. Is it very hard to set up your own blog? I’m not very techincal but I can figure things out pretty fast. I’m thinking about creating my own but I’m not sure where to begin. Do you have any points or suggestions? Cheers

kamagra oral jelly: kamagra en ligne – Kamagra pharmacie en ligne

pharmacie en ligne france livraison belgique: Livraison rapide – Pharmacie sans ordonnance pharmafst.com

Acheter Kamagra site fiable: Kamagra Commander maintenant – acheter kamagra site fiable

Achat Cialis en ligne fiable: Acheter Cialis – Cialis sans ordonnance 24h tadalmed.shop

kamagra en ligne: Acheter Kamagra site fiable – Acheter Kamagra site fiable

kamagra oral jelly: kamagra 100mg prix – kamagra en ligne

Pharmacie Internationale en ligne: Meilleure pharmacie en ligne – vente de mГ©dicament en ligne pharmafst.com

Acheter Kamagra site fiable: Achetez vos kamagra medicaments – Kamagra Oral Jelly pas cher

pharmacie en ligne fiable: pharmacie en ligne pas cher – pharmacie en ligne livraison europe pharmafst.com

Achetez vos kamagra medicaments: achat kamagra – Kamagra Commander maintenant

Kamagra Oral Jelly pas cher: Kamagra Oral Jelly pas cher – kamagra 100mg prix

Pharmacie en ligne Cialis sans ordonnance: Cialis sans ordonnance 24h – Cialis sans ordonnance 24h tadalmed.shop

kamagra livraison 24h: achat kamagra – kamagra en ligne

trouver un mГ©dicament en pharmacie: Pharmacie en ligne France – pharmacie en ligne avec ordonnance pharmafst.com

pharmacie en ligne france livraison internationale: pharmacie en ligne pas cher – pharmacies en ligne certifiГ©es pharmafst.com

achat kamagra: achat kamagra – kamagra gel

Tadalafil 20 mg prix en pharmacie: cialis prix – Cialis en ligne tadalmed.shop

pharmacie en ligne fiable: pharmacie en ligne pas cher – pharmacie en ligne france livraison internationale pharmafst.com

cialis generique: Cialis sans ordonnance 24h – Tadalafil sans ordonnance en ligne tadalmed.shop

Tadalafil achat en ligne: Cialis sans ordonnance 24h – Acheter Viagra Cialis sans ordonnance tadalmed.shop

Tadalafil 20 mg prix en pharmacie: Tadalafil 20 mg prix en pharmacie – Achat Cialis en ligne fiable tadalmed.shop

pharmacie en ligne livraison europe: Livraison rapide – vente de mГ©dicament en ligne pharmafst.com

legit canadian pharmacy: canada drugs – drugs from canada

canadian pharmacy ltd: Canadian pharmacy shipping to USA – canadian pharmacy uk delivery

MedicineFromIndia: indian pharmacy – indian pharmacy paypal

indian pharmacy: Medicine From India – indian pharmacy

mexican rx online: RxExpressMexico – mexico drug stores pharmacies

medicine courier from India to USA [url=https://medicinefromindia.com/#]medicine courier from India to USA[/url] medicine courier from India to USA

mexico drug stores pharmacies: Rx Express Mexico – RxExpressMexico

canadian world pharmacy: canadian pharmacy sarasota – canadian pharmacy

Medicine From India: cheapest online pharmacy india – indian pharmacy

indian pharmacy online [url=https://medicinefromindia.com/#]MedicineFromIndia[/url] indian pharmacy online

canadian pharmacy ltd: Express Rx Canada – canadian pharmacy online reviews

mexican online pharmacy: mexico drug stores pharmacies – Rx Express Mexico

canada ed drugs [url=https://expressrxcanada.com/#]Express Rx Canada[/url] canadian pharmacy prices

Medicine From India: medicine courier from India to USA – indian pharmacy

mexico pharmacy order online [url=https://rxexpressmexico.com/#]mexico pharmacies prescription drugs[/url] mexican rx online

canadian pharmacy phone number: Generic drugs from Canada – canadian pharmacy 365

vavada: vavada – вавада зеркало

vavada вход: вавада – вавада

pin up: pin up casino – pin up casino

pin up: pin-up casino giris – pin-up casino giris

пин ап казино официальный сайт: пин ап зеркало – пинап казино

vavada вход: вавада – vavada casino

pin up: pinup az – pin up

pinup az: pin up az – pin up az

вавада казино: вавада казино – vavada вход

vavada casino: vavada вход – vavada

пинап казино: pin up вход – пин ап зеркало

вавада зеркало: вавада официальный сайт – vavada

pin up: pin up azerbaycan – pin up casino

vavada: вавада казино – вавада

pin up: pin-up – pinup az

pin up вход: pin up вход – пин ап вход

вавада официальный сайт: вавада – вавада зеркало

pin up вход: pin up вход – пин ап вход

пин ап казино: пинап казино – пин ап зеркало

pin up az: pin up – pin-up casino giris

пин ап вход: пин ап казино – пин ап казино официальный сайт

пин ап казино официальный сайт: пинап казино – pin up вход

вавада официальный сайт: вавада официальный сайт – vavada casino

Here to join conversations, exchange ideas, and learn something new along the way.

I’m interested in hearing diverse viewpoints and adding to the conversation when possible. Interested in hearing new ideas and meeting like-minded people.

Here is my website-https://automisto24.com.ua/

Here to dive into discussions, exchange ideas, and gain fresh perspectives along the way.

I enjoy hearing diverse viewpoints and contributing whenever I can. Interested in hearing fresh thoughts and connecting with others.

That’s my site:https://automisto24.com.ua/

вавада казино: vavada вход – вавада

пинап казино: пин ап казино официальный сайт – пин ап вход

пинап казино: pin up вход – пин ап казино

pin up azerbaycan: pin up casino – pin-up

Modafinil for sale: buy modafinil online – verified Modafinil vendors

doctor-reviewed advice: safe modafinil purchase – Modafinil for sale

best price Cialis tablets: secure checkout ED drugs – cheap Cialis online

cheap Cialis online: best price Cialis tablets – cheap Cialis online

FDA approved generic Cialis: secure checkout ED drugs – secure checkout ED drugs

Modafinil for sale: modafinil 2025 – doctor-reviewed advice

secure checkout Viagra: fast Viagra delivery – trusted Viagra suppliers

no doctor visit required: order Viagra discreetly – fast Viagra delivery

modafinil pharmacy: Modafinil for sale – legal Modafinil purchase

fast Viagra delivery: order Viagra discreetly – Viagra without prescription

https://zipgenericmd.shop/# discreet shipping ED pills

buy modafinil online: safe modafinil purchase – buy modafinil online

modafinil 2025: legal Modafinil purchase – purchase Modafinil without prescription

legal Modafinil purchase: doctor-reviewed advice – modafinil legality

https://zipgenericmd.shop/# cheap Cialis online

secure checkout ED drugs: order Cialis online no prescription – reliable online pharmacy Cialis

http://modafinilmd.store/# modafinil pharmacy

FDA approved generic Cialis: cheap Cialis online – FDA approved generic Cialis

cheap Viagra online: no doctor visit required – secure checkout Viagra

http://modafinilmd.store/# safe modafinil purchase

prednisone 20 mg tablets coupon: PredniHealth – prednisolone prednisone

where to buy generic clomid tablets: Clom Health – where buy generic clomid prices

can you get cheap clomid without a prescription: can you get clomid without dr prescription – order generic clomid without rx

Amo Health Care: buy amoxicillin 500mg capsules uk – 875 mg amoxicillin cost

Amo Health Care: ampicillin amoxicillin – Amo Health Care

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

) سأعيد زيارتها مرة أخرى لأنني قمت بوضع علامة كتاب عليها. المال والحرية هي أفضل طريقة للتغيير، أتمنى أن تكون غنيًا و

batman688

buy cialis generic online 10 mg: TadalAccess – cialis dosage for ed

generic tadalafil tablet or pill photo or shape: how to take liquid tadalafil – cialis 2.5 mg

cialis buy without: Tadal Access – canada pharmacy cialis

cialis professional vs cialis super active: cialis daily – cialis coupon code

Hello.This post was really motivating, especially because I was searching for thoughts on this topic last week.

råb ud og sig, at jeg virkelig nyder at læse gennem dine blogindlæg.

It’s nearly impossible to find well-informed people in this particular subject, however, you seem like you know what you’re talking about! Thanks

webové stránky jsou opravdu pozoruhodné pro lidi zkušenosti, dobře,

Great site you have here.. It’s hard to find good quality writing like yours these days. I honestly appreciate people like you! Take care!!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

grupo do facebook? Há muitas pessoas que eu acho que iriam realmente

used trucks are sometimes expensive and it is quite hard to find a good bargain if you don’t search heavily”

Missing funds on your QIWI wallet?We know how stressful that can be.Fear not—our team specializes in retrieving missing money from QIWIwallets.With years of experience, we’re sure we can assist you.Get in touch and let’s begin of recovering your funds.

Over the counter antibiotics for infection: buy antibiotics online uk – cheapest antibiotics

http://eropharmfast.com/# Ero Pharm Fast

cheapest antibiotics: buy antibiotics from canada – get antibiotics without seeing a doctor

buy antibiotics from canada [url=https://biotpharm.com/#]buy antibiotics online[/url] buy antibiotics

Ero Pharm Fast: Ero Pharm Fast – Ero Pharm Fast

what is the cheapest ed medication: ed med online – Ero Pharm Fast

Azino777 — это ведущих онлайн-казино в России . Портал предлагает множество развлечений , особые преимущества и надежность сервиса . В этой материале мы тщательно изучим все особенности использования Azino777 . Развитие Азино777 Azino777 начало свою работу в прошлом десятилетии и стремительно получило доверие среди любителей азартных игр. Портал создавалась с акцентом на удобство использования и разнообразие развлечений . С момента запуска Азино777 стало одним из лучших игровых платформ в России . Уникальный дизайн и непрерывное развитие списка развлечений превращают Azino777 в идеальный выбор для игроков . Сильные стороны Азино777 Портал Azino777 предоставляет множеством преимуществ , которые делают его среди конкурентов . Рассмотрим основные из них: Большой ассортимент развлечений Azino777 предоставляет огромное количество игровых автоматов от популярных компаний. В их числе можно найти уникальные развлечения, покер и другие варианты .Удобный интерфейс Платформа Azino777 разработан с ориентиром на простоту взаимодействия . Даже если новичок быстро освоится с интерфейсом . Защита Azino777 внедряет передовые методы защиты , чтобы предоставить защиту информации пользователей . Специальные предложения Платформа постоянно дарит бонусы всем клиентам. В списке можно найти бесплатные спины . Адаптивный дизайнАзино777 работает на мобильных устройствах . Адаптивный дизайн обеспечивает играть в любое время .Как начать играть Для начала игры на Azino777, следует создать аккаунт. Процедура занимает несколько минут :Перейдите на платформу Azino777. Кликните на кнопку «Создать аккаунт». Укажите информацию. Активируйте регистрацию .После регистрации вы сможете внести депозит и играть азартными развлечениями . РазвлеченияАзино777 предоставляет широкий выбор игр . Среди них можно найти: Игровые автоматыКлассические игры с разными особенностями. Блэкджек Любимые настольные игры для настоящих ценителей .Лайв-казино Реалистичный опыт азарта с живыми ведущими . Вывод Azino777 — это надежная платформа для азартных игр , которая предоставляет множество слотов, интуитивное управление и высокий уровень сервиса . Платформа идеален как для начинающих игроков , так и для опытных игроков . Регистрируйтесь и получайте удовольствие азарта уже сегодня!

Pharm Au 24: Pharm Au24 – Licensed online pharmacy AU

buy antibiotics online [url=http://biotpharm.com/#]buy antibiotics online uk[/url] best online doctor for antibiotics

https://eropharmfast.shop/# Ero Pharm Fast

Ero Pharm Fast: Ero Pharm Fast – cheap ed meds online

Ero Pharm Fast: online prescription for ed – cost of ed meds

Online medication store Australia: Online medication store Australia – Licensed online pharmacy AU

get antibiotics quickly: buy antibiotics – buy antibiotics from canada

Online drugstore Australia [url=http://pharmau24.com/#]Buy medicine online Australia[/url] Licensed online pharmacy AU

https://pharmau24.com/# Licensed online pharmacy AU

Thimbles is a casino game that takes players into a realm of lighthearted fantasy. Once you’ve got the basics down, you can start the game. For your first action, you’ll need a starting bet. Once you’ve done that, you press Green, Yellow or Red. Each of these options corresponds to a row of multipliers under the pins. When you choose the Green button, for example, you’ll see a green disc appear. This disc falls from the top of the board and begins a descent downwards, being deflected by the pins. The number it lands on is the coefficient applied to your bet. It’s worth pointing out that the colour of the disc must be associated with the corresponding row of multipliers. Green for the first row, Yellow for the middle row and Red for the bottom row. Install the app and get bonuses Top online casinos

http://forum.dmec.vn/index.php?members/riogentsacha1987.115233/

The funniest eternal question…They’re tearing down a novelty factory to make way for a new freeway! The first Rubber Chicken to make it back can save the day and become the king of novelties. It’s a race to build an idyllic garden path back home as your opponents build freeways blocking your way. We provide the motivation, but you provide the how. Fun and funny! Includes four game pieces with plastic stands, 108 2-1 4″ x 3-7 16″ (5.7 cm x 8.7 cm) illustrated playing cards and one die. Comes in a 7-1 2″ x 4-3 8″ x 1-5 8″ (19 cm x 11.1 cm x 4.1 cm) illustrated box. Shrink-wrapped. Turnstiles open at 1pm. The Fans Zone marquee will be open for all supporters ahead of kick-off with a variety of alcoholic drinks on offer, including real ale, cider and beer, while the Urban Street Food food truck will be offering a whole host of tasty food options throughout the afternoon, from burgers and hot dogs, to jerk chicken and chicken chow mein and everything in between.

ed medications cost: Ero Pharm Fast – top rated ed pills

buy antibiotics from india: Biot Pharm – buy antibiotics from india

You’re so awesome! I don’t suppose I’ve read through a single thing like this before. So good to find another person with unique thoughts on this topic. Really.. thank you for starting this up. This web site is something that is required on the internet, someone with a little originality.

buy antibiotics for uti: buy antibiotics online uk – cheapest antibiotics

Pharm Au 24 [url=https://pharmau24.shop/#]online pharmacy australia[/url] Licensed online pharmacy AU

http://pharmau24.com/# PharmAu24

order ed pills online: Ero Pharm Fast – Ero Pharm Fast

best online doctor for antibiotics: BiotPharm – antibiotic without presription

Ero Pharm Fast [url=https://eropharmfast.shop/#]Ero Pharm Fast[/url] get ed meds online

You’re so interesting! I don’t suppose I’ve read through anything like that before. So great to discover somebody with a few genuine thoughts on this subject matter. Seriously.. thank you for starting this up. This website is one thing that is needed on the internet, someone with some originality.

يمكنك الدخول على قسم المراهنات الرياضية من خلال النقر على “Sports” في القائمة الرئيسية في موقع وان ایکس بت. وسيُعرض لك جميع الالعاب الرياضية المختلفة المتاحة في شريط التمرير الموجود في وسط الشاشة، وعندما تضع المؤشر فوق رياضة معينة، سترى المبارايات المتاحة التي يمكن لك المراهنة عليها. يوفر 1xbet كازينو مصر دعمًا فنيًا وخدمة عملاء مميزة لجميع مستخدميه. سواء كنت تواجه مشكلة في تنزيل برنامج 1xbet أو تحميل 1xbet اخر إصدار، أو تحتاج إلى مساعدة في تحميل لعبة 1xbet، فإن فريق الدعم الفني جاهز لمساعدتك على أي وقت.

https://navagrahaastrology.in/%d9%85%d8%b2%d8%a7%d9%8a%d8%a7-%d9%84%d8%b9%d8%a8%d8%a9-%d8%a7%d9%84%d8%b7%d9%8a%d8%a7%d8%b1%d8%a9-%d9%85%d8%b1%d8%a7%d9%87%d9%86%d8%a7%d8%aa-%d9%88%d9%84%d9%85%d8%a7%d8%b0%d8%a7-%d9%8a%d9%81/

1- تحسينات في أداء التطبيق: يأتي التحديث الجديد بتحسينات تحميل سكربت الطيارة 1xbet مجانا مما يجعله أكثر استجابة وسرعة في تنفيذ الأوامر والعمليات المختلفة. عندما تتعرف على الفروق الأساسية في اللعبة، فقد حان الوقت للتسجيل في 1xbet والبدء في اللعب مقابل المال في Lucky Jet. نظام الجوائز في مرآة ألعاب 1 بيت متنوع ويتضمن جوائز لكل من المراهنات الرياضية ووضع الكازينو. يمكن تطبيق المكافآت التالية في لعبة الطيار: تتنافس أفضل وأشهر منصات المقامرة وألعاب الكازينو عبر الإنترنت في توفير لعبة الطائرة الحقيقية للعب في المغرب. تسعى كل منصة في إثبات مكانتها من خلال مزايا وخصائص حصرية لتعزيز تجربة اللعب الخاصة بك. فيما يلي أفضل الخيارات المتاحة للاعبين المغاربة للاستمتاع بتجربة لعبه طياره الفلوس الممتعة.

Quality articles or reviews is the main to invite the users to pay a quickvisit the web page, that’s what this web page is providing.

Thank you for your engaging insights! Your writing style brings clarity to complex subjects and makes them feel relatable. The real-life examples you share add a personal element that really connects. Eager to see how you expand on these ideas! Your dedication to valuable content is commendable.

I was just searching for this info for a while. After six hours of continuous Googleing, at last I got it in your website. I wonder what’s the lack of Google strategy that do not rank this type of informative web sites in top of the list. Normally the top websites are full of garbage.

Greetings! Very useful advice in this particular article!It’s the little changes that produce the biggest changes.Many thanks for sharing!

The very core of your writing whilst appearing agreeable initially, did not really sit very well with me personally after some time. Someplace throughout the sentences you actually managed to make me a believer unfortunately just for a short while. I still have a problem with your leaps in logic and one might do well to fill in all those breaks. In the event you actually can accomplish that, I could surely end up being impressed.

100% Safe |100% Legal | 100% Secure Friends, as soon as you do this process, you can get unlimited bonus from these slot apps and by playing games with the bonus money and making 100, you can transfer it to your bank account that too without any payment. deposited You can get free chips by claiming daily login bonuses, inviting friends, and joining special events and promotions. दोस्तों अगर आप लोग भी New Rummy Application को डाउनलोड करने में रुचि रखते हैं और आप लोग भी रमी गेम खेलने के शौकीन है, तो आप लोग RummyBonusApp.Com के माध्यम से इन सभी एप्लीकेशंस को डाउनलोड कर सकते हैं,

https://laundrymart.id/aviator-game-review-raceup-thrills-for-canadian-players/

Note :- If You Have an Application Company and You Also Want to Promote Your Application, Then You Can Contact us on This Email Given Above and You Can Get Your Application Advertised on Our Website. Dragon Tiger: An Ultimate Real-Time Multiplayer Card Game Friends, you can see in the image below that this application gives very quick withdrawal, this application is very good, if you have not yet downloaded this application, please download immediately because this application is a real gaming application and provide real cash. Friends, this application is not fake, it is very real and it gives payment within 15 minutes, so you must download it. Dragon Tiger Slots – Up Down provides a refreshing twist on traditional card games with the addition of slot machine elements. This unique gameplay ensures hours of entertainment and strategic planning. Though the mechanics may appear overwhelming to beginners, the hint feature makes the game more user-friendly and engaging.

Greetings! This is my first visit to your blog! We are a team of volunteers and starting a new project in a community in the same niche. Your blog provided us useful information to work on. You have done a wonderful job!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

how to buy generic clomid tablets generic clomid price how to get generic clomiphene can you buy generic clomid online buying clomiphene without dr prescription can you buy generic clomid pills where can i buy generic clomiphene without prescription

že spousta z něj se objevuje na internetu bez mého souhlasu.

Stop the indicators and catch the ball friv2013, friv 2021, friv games, kizi4school, frin 2, Stop the indicators and catch the ball Los juegos de fútbol existen desde hace muchísimo tiempo, incluso desde antes que la primera consola de videojuegos. Cuando aparecieron las primeras consolas, empezamos a ver juegos como Fifa y Football Manager, que ahora son franquicias muy conocidas. friv2010, friv20, friv22, friv2014, friv100000, friv1000000, friv77, Número de votos: 5 Use Left Mouse button to Stop the indicators and catch the ball, Clica en el botón izquierdo del ratón y arrastra hacia el arco. Puedes instalar este juego en tu escritorio para un acceso más rápido El sitio, Friv 260, solo ofrece los últimos Juegos Friv 260 para disfrutar. Impresionantes Juegos de Friv 260 gratis te están esperando para probarlos. Con este portal, Friv 260, es posible descubrir Juegos Friv 260 hermosos. Disfruta de tu tiempo para analizar los magníficos Juegos de Friv 260 gratis. Friv 260: Encuentra Los Mejores Juegos Friv 260

https://asignar.es/uncategorized/balloon-analisis-tecnico-para-jugadores-experimentados/

Free Online Games online games your gateway to a world of free online entertainment! Explore a vast collection of games, from puzzles and card games to action and arcade classics. Play instantly on any device without registration or downloads rxguides.net Discover the best game codes, in-depth guides, and updated tier lists for your favorite games! Unlock exclusive rewards, master gameplay strategies, and find the top characters or items to dominate the competition. Start your journey to success today! 1Win es una casino en línea y casa de apuestas en Argentina que ofrece una enorme selección de apuestas deportivas, casino en vivo, póquer y juegos de casino de los mejores proveedores. Con un increíble paquete de bienvenida de 500% hasta 390.000 ARS, podrás aumentar tus ganancias. No pierda esta oportunidad y únase a 1Win Argentina ahora mismo.

рџ”Ћ Don’t play any color-guessing game blindly. It can furthermore push you to lose. Fallow app predictions your possibilities of bringing loss will be less. Red: 2,4,6,8 = 2X; 0 = 1.5X; Remember to embrace the excitement of chance, enjoy the experience, and most importantly, have fun as you venture into the realm of colour prediction game online! The thrill of color prediction games ensures a fun experience that keeps players coming back for more, whether they decide to play for fun or to try to win prizes. Mantri Mall-Color Predictor has Some Tricks of the рќђЊрќђљрќђ§рќђрќђ«рќђў 𝐌𝐚𝐥𝐥 Game. You need to follow that help you will be in earnings. If you have invested in real prize-winning games, Then you need this predictor app. You will correspondingly be able to make a profit. If you’re seeking a fast and effortless, then the Mantri mall color prediction opportunity is for you! This easy technique can help you bring profit and quizzes earn money.

https://solohanks.com/jili-mines-experience-in-the-philippines-why-players-love-it/

As Ukraine continues to bolster its defenses, having cutting-edge offensive weapons like the AGM-158A JASSM cruise missiles is crucial. Yet, equally essential are advanced communication systems such as Link 16. This system is vital for coordinating military operations and is widely utilized by NATO, but the U.S. hesitates to share this technology with Kyiv, fearing it might end up in Russian hands. *Your rate will be 0% or 10–36% APR based on credit, and is subject to an eligibility check. Payment options depend on your purchase amount, and a down payment may be required. Payment options through Affirm are provided by these lending partners: affirm lenders. Watch the Jets quarterback and receiver link-up for a big play during 7-on-7 drills at OTA practice. Free Delivery on all major appliances $399+ § See Details

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Hey! I know this is kinda off topic but I’d figured I’d ask. Would you be interested in trading links or maybe guest writing a blog article or vice-versa? My blog discusses a lot of the same topics as yours and I feel we could greatly benefit from each other. If you happen to be interested feel free to shoot me an e-mail. I look forward to hearing from you! Great blog by the way!

Sed quia non numquam eius modi tempora incidunt ut labore et magnam aliquam quaerat voluptatem nostrum. Introducing JetX, the game that is revolutionizing the online gambling sector! Developed by SmartSoft Gaming, this innovative arcade slot is taking players on a thrill ride unlike anything they’ve ever experienced before. With a unique gaming experience that breaks the traditional rules of slots, JetX is all about primitive human instincts. The fear of missing out is the driving force behind the game, as players feel the pressure to keep up with others who are potentially winning money, while they risk losing their profits. There are dozens of ubiquitous and encrypted payment systems, such as Pix, ecoPayz, MasterCard, Skrill, Neteller, and Visa debit cards, and Bitcoin. Sed quia non numquam eius modi tempora incidunt ut labore et magnam aliquam quaerat voluptatem nostrum.

https://petsobituaries.devsaffinity.site/plane-crash-money-game-legit-or-rigged/

Olabet.co.mz is the go-to place for an exciting online gaming experience! It is home to some of the top online arcade-style games like the favorite JetX. This top game in Mozambique is bound to enhance your gaming experience with its designs and winning opportunities. It brings immersive gameplay and entertainment to keep you on the edge of your seat at all times! The goal of the Aviator casino game is to collect your winnings in time before the plane disappears. In the crash game, you need to bet an airplane taking off with an increasing multiplier. The multiplier increases in proportion to the height gained by the airplane. To win in Aviator choose the best time to withdraw your bet. The peculiarity of the game is the mechanics of the disappearance of the airplane. Do not hesitate, a long wait can cause the airplane to disappear or fly off the screen. By disappearing it will take your bet with it.

Your article helped me a lot, is there any more related content? Thanks!

Jetx Game casinos also offer various bonuses and promotions to players in France. Visit the official Jet X Casino website to find up-to-date promo codes offering generous rewards. Make sure to read all the terms and conditions before claiming any bonus or promotion. Since its debut in 2018, crash games have surged in popularity, surpassing traditional gaming choices. SmartSoft Gaming leads the charge in this arena, developing innovative solutions like JetX. JetX blends skill, strategy, and luck, offering boundless excitement and top-notch quality. Gotsadze targets mobile and video gaming enthusiasts, aiming to enter markets with a robust gaming culture, initially prioritizing regions craving dynamic content. RESPONSIBLE GAMING: jetxgame is a responsibly gaming advocate. We make every effort to ensure that our partners respect responsibly gaming. Playing in an online casino, from our perspective, is intended to provide pleasure. Never be concerned about losing money. If you’re upset, take a break for a while. These methods are meant to assist you in maintaining control of your casino gaming experience.

https://ccr.com.mx/the-ultimate-guide-to-how-to-track-crash-history-in-spincity-aviator/

The “I” nozzles, also known as “Control” nozzles, produce an elongated jet shape with a small run-off zone and a drier jet core. They have a slower application speed but offer maximum control. The film build-up per layer is slightly reduced compared to an “O” nozzle of the same size. St. Louis, MO – Associated Couriers LLC, a leading US supplier for radiopharmaceutical and healthcare logistics, acquires Jet X Delivery Service, thus expanding its footprint as well as its area of expertise. The Paroli JetX strategy is better suited to losing less than winning more and is ideal for beginners to study JetX betting. Experienced players may find it boring, but JetX starters will definitely love it. Also, there is an anti-Paroli strategy that requires increasing bets after losses and decreasing after wins. Unlike the basic strategy, anti-Paroli strives to balance out both risks and winnings.

Hello, I think your site might be having browser compatibility issues. When I look at your blog in Ie, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, superb blog!

https://semaglupharm.com/# Semaglutide tablets without prescription

An intriguing discussion is worth comment. I believe that you should write more about this topic, it might not be a taboo matter but generally folks don’t talk about such subjects. To the next! All the best!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

To notice Spina Zonke online games only by one developer such since Habanero, for example, click on the appropriate key Dlaczego warto zainwestować w stanik? However, there’s still time for investors to capitalize on the opportunity to earn more interest from uninvested cash — as you’ll see below, rates remain relatively high. Webull is a great pick for mobile trading, not only for no commissions on stocks and options but also for its new addition of futures. Vanguard is known for its low-cost funds, and the investment platform is really built for those looking to invest solely in mutual funds and ETFs. Wenecja, Padwa, Asyż, Rzym, Florencja, Piza Apresentamos o projeto a todos os membros da comunidade educativa e conseguimos perceber o entusiasmo dos mesmos, mesmo quando não tinham uma ideia clara do que é inclusão. Por exemplo, falamos com os funcionários e estes produziram um cartaz. Foram os primeiros a entregar o seu trabalho pronto, muito antes do prazo de entrega. É este compromisso, é esta entrega que precisamos, para que todos possam ter acesso, possam permanecer, participar e ter sucesso nas mais variadas esferas da sua vida.

https://sugarbgenba1987.cavandoragh.org/zalecana-strona

Online roulette games have reinvented the means gamers experience the excitement and enjoyment of gambling establishment gaming. With reasonable graphics, immersive sound effects, and a vast array of betting alternatives, online roulette uses a truly extraordinary gaming experience for gamers all over the world. Whether you are an amateur or a knowledgeable player, on the internet roulette video games give unlimited home entertainment and opportunities to win large. So why wait? Sign up with the enjoyment of on the internet roulette today and experience the thrill of the rotating wheel for yourself! Mostbet is one of India’s masalabox mostbet-a-review-of-the-most-popular-bookmaker-in-india most well-known bookmakers that offer bets on almost all kinds of sports, including eSports and casino games. Read more here.

Możesz łatwo pobrać wersję mobilną Aviator z Google Play lub App Store. W obu przypadkach wystarczy zainstalować ją na swoim urządzeniu i cieszyć się grą. Pobieranie Gry Aviator jest takie proste! Aviatrix to kolejna ekscytująca gra crash, podobna do Aviator, w której runda kończy się nie wtedy, gdy samolot znika z ekranu, ale gdy eksploduje. Gra oferuje dynamiczną rozgrywkę z wieloma interesującymi funkcjami, które przyciągają entuzjastów hazardu. Also keep in mind this app is still somewhat in development (I guess?) so if you notice any kind of bug in the game, or feel like commenting or suggesting something then drop a comment. W prezentacji wirtualnych kasyn są już dwie wersje Aviator Zanurz się w ekscytującym świecie lotnictwa bez ryzyka dzięki demo wersji Aviator na stronie Most bet w Polsce. Ta wersja demonstracyjna pozwala zapoznać się z charakterystyczną mechaniką obstawiania w grze i doskonalić umiejętności wyczucia czasu, aby zmaksymalizować współczynniki. Dopracuj swoje strategie i poczuj dreszczyk emocji związany z szybującymi wynikami, zanim zanurzysz się w prawdziwej grze. Wystartuj już dziś i odkryj emocje na wysokości jak nigdy dotąd!

http://bbs.sdhuifa.com/home.php?mod=space&uid=866140

20Bet kasyno obsługuje również przelewy finansowe oraz skromniej tradycyjne procedury, tego typu w który sposób karty przed… CHÍNH SÁCH 20Bet kasyno obsługuje również przelewy finansowe oraz skromniej tradycyjne procedury, tego typu w który sposób karty przed… sportingbet+bet Na prostu wpisz swoje imię, link e-mail i jest to, w czym potrzebujesz obsługi, a odpowiedź pojawi się w ciągu 24 godzin. Strona wydaje się być zar… Rất tiếc, sản phẩm này hiện không tồn tại. Hãy chọn một phương thức kết hợp khác. Bon Nuts, Ground Floor, SKJ International Vintage, H.No : 8, 2-577 1 A 4, Rd Number 7, Banjara Hills, Hyderabad, Telangana 500034+91 89089 01213Locate us sportingbet+bet © Copyright 2020. Sublime Kupa. Tüm Hakları Saklıdır. Para yatırma ve çekme işlemleri Mostbet hesabınızdan, çeşitli ödeme yöntemleri kullanılarak yapılabilir. Bunlar arasında banka havalesi, kredi kartları, e-cüzdanlar ve kripto afin de birimleri bulunmaktadır. Bu basit adımlar, Mostbet’in Windows versiyonunu cihazınıza kolayca yüklemenizi sağlar. İndirme ve kurulumla ilgili daha fazla bilgi ve destek için Mostbet Türkiye’nin web sitesini ziyaret edebilirsiniz. Eğer hesabınıza erişimde sorun yaşarsanız, şifremi unuttum seçeneği ile şifrenizi sıfırlayabilir veya 24 7 canlı destek hattından yardım alabilirsiniz. Mostbet, kullanıcılarının sorunsuz bir giriş yapabilmesi için kolay ve güvenli bir platform sunar.

Saturday and public holidays before 9 am and after eleven pm.

Hi, I do believe this is a great blog. I stumbledupon it 😉 I may return once again since I bookmarked it. Money and freedom is the best way to change, may you be rich and continue to help others.

By admin|2025-01-16T09:27:40+00:00January 16th, 2025|Download Mostbet App Apk 2024 For Android & Ios In Bangladesh – 720| Russian ladies are recognized for having a lot of the characteristics of thefederalist 2020 04 15 why-child-abuse-is-more-likely-in-polyamorous-homes-like-the-woman-with-four-boyfriends a great wife. Examples include their good sense of figure, beauty, and flexible, open-minded nature. In addition, they learn how to balance all their femininity and self-esteem. They are also very dedicated to their partners. These qualities make Russian women a most wonderful choice for men looking for a spouse from another part of the world. Once installed, the iphone app is looking forward to make use of, giving usage of all features straight from the particular phone. Verification is important for protecting your and creating the safe betting room. By downloading the particular app from the App Store, you receive the latest edition with automatic improvements.

https://graspos-data.athenarc.gr/user/ndolsynthtradat1979

sol-casino-apk.ru sol-apk >> Install Ninja Fun Race today. It’s FREE! Outfit your character in Ninja Garbs and other fun costumes. Outfit your character in Ninja Garbs and other fun costumes. volna-casino-apk.ru volna-apk aviator mostbet aviator mostbet . RACE REAL PEOPLE IN REAL-TIME. lioleo.edu.vn app-dang-ky-thanh-cong 4.png.php?id=slot-apk-bet lioleo.edu.vn app-dang-ky-thanh-cong 4.png.php?id=slot-apk-bet >> Install Ninja Fun Race today. It’s FREE! • Jump, then double jump! apk.luckyduck-casino-apk.ru aviator mostbet aviator mostbet . • Jump, then double jump! sol-casino-apk.ru sol-apk 1 win apk 1 win apk . Nie ma jeszcze żadnych recenzji ani ocen! Aby napisać pierwszą aviator mostbet aviator mostbet . lioleo.edu.vn app-dang-ky-thanh-cong 4.png.php?id=slot-apk-bet

There don’t appear to be any potential obstacles that stop you from making a deposit, transferring money into and out of your online casino account is straightforward. If you don’t see a particular brand that you’re interested in listed in our guide, which are easy and very fun. To avoid these charges, amsterdam gambling hints maintains a full-fledged mobile version. Here, in the British Virgin Islands. If you are looking for a safe online casino that is fun, while deposits at TrueBlue are instant for all deposit methods. Natürlich punktet Sweet Bonanza auch mit einer Reihe von Bonus-Features, um das Spielerlebnis abzurunden. Hier sei vor allem das Tumble-Feature zu erwähnen. Dieses aktiviert sich, wenn der Spieler auf den Walzen eine Gewinnkombination erzielt. Die Gewinnsymbole verschwinden dann von den Walzen, während die übrig Gewinnlinien mit neuen Symbolen gefüllt werden. So bekommt der Spieler nach jedem Gewinn eine Extra-Runde mit zusätzlicher Gewinnchance.

https://socialbookmarkingsitelist.xyz/page/business-services/ich-habe-es-gefunden

Spieler, die schnell auf die Sonderfunktionen des Spiels zugreifen möchten, haben die Möglichkeit, direkt Freispiele zu erwerben. Der Zugriff auf diese Funktion erfolgt über eine bestimmte Schaltfläche auf der Benutzeroberfläche des Spiels. Die Kosten für die Aktivierung dieser Bonusrunden entsprechen im Allgemeinen dem 100-fachen des aktuellen Einsatzes des Spielers. Diese Funktion kann wiederholt genutzt werden und ist eine attraktive Option für Spieler, die ihr Spiel aufwerten möchten. Der Sweet Bonanza Slot präsentiert eine farbenfrohe und phantasievolle Kulisse mit einem pastellfarbenen Himmel und Landschaften, die an ein Dessert-Wunderland erinnern. Die Grafik des Spiels ist lebhaft und zeigt eine Vielzahl von Früchten und Süßigkeiten, die gut gestaltet sind und sich von dem skurrilen Hintergrund abheben. Dieses Design ist eine Hommage an die klassischen Fruchtspielautomaten und verleiht dem traditionellen Konzept ein modernes Flair.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

For those interested in exploring more from this series, check out our reviews on Big Bass Bonanza and Big Bass Splash. Comparing Big Bass Amazon Xtreme to its predecessor, Big Bass Bonanza Hold & Spinner, the new installment enhances the gameplay with innovative features and an Amazonian setting, offering a more dynamic and immersive angling adventure. Home – Slots – Big Bass Amazon Xtreme We stake our reputation on these reviews, ensuring each site is trustworthy, secure, and boasts an impressive slot lineup, including the thrilling Big Bass Amazon Xtreme.. Following a £10 minimum deposit, new players can claim a 100% Match Up Bonus up to £200 + 50 Free Spins on Big Bass Bonanza (T&Cs apply). Through this offer, you could potentially win up to £200 in bonus funds. Prepare your fishing gear and brace yourself for a thrilling angling adventure as Pragmatic Play partner Reel Kingdom takes the Big Bass series to new heights with their latest installment, Big Bass Amazon Xtreme. As fans of the series already know, Reel Kingdom has established a solid reputation with their previous Big Bass releases, captivating players with their immersive fishing-themed gameplay. While some may be skeptical about the release of yet another Big Bass slot, it’s hard to ignore the series’ undeniable popularity and the anticipation it generates among avid players.

https://hitechgroup.xyz/page/business-services/click-this-link

Bigger Bass Bonanza Amazon can be extremely dangerous with waterfalls appearing unexpectedly. And in Big Bass Amazon Xtreme this can happen to you at any moment. But this isn’t something to be afraid of because any waterfall leaves a bunch of fish and a fisherman to collect the prizes. Big Bass Amazon Xtreme follows a classic structure, featuring a 5-reel, 3-row grid and 10 paylines. The game offers many exciting features, so let’s explore them. Not all Big Bass slot games have the same return to player, with the range covering the highest at initial release of Big Bass Bonanza at 96.71% with the lowest in some of the more recent releases like Big Bass Amazon Xtreme and Big Bass Halloween. The Pragmatic Play game Big Bass Amazon Xtreme may catch your attention really fast. It came out on June 5, 2023. It’s a game that combines simple unique theme and different features. It tries to hook players with its mix of fun and big wins. This slot is great for people who want to win big because it has a high risk and a maximum win of x10000 the bet. Slot fans love Big Bass Amazon Xtreme because it has fun features and the chance to win big.

¡Usa tu ratón para bloquear al objetivo y patear! Murcia progress to the playoff final and a shot at reaching the second division, while Barça will have to make do with being part of the Primera RFEF, the new 40-team, two division third tier of Spanish football. Los usuarios de Penalty shootout – Game le dio una calificación de 4 fuera de 5 estrellas. Scopri la nuova estensione Minigiochi Chrome En football manchester-city CHANNELS TO WATCH PORTUGAL VS MACEDONIA Your browser doesn’t support HTML5 audio Murcia progress to the playoff final and a shot at reaching the second division, while Barça will have to make do with being part of the Primera RFEF, the new 40-team, two division third tier of Spanish football. This and a set of campaign achievements and Tour Events can see players gain huge in-game item collections – all necessary on the road to glory in the world’s leading free-to-play football simulation game.

https://alhawra.ly/balloon-y-el-dinero-facil-mito-o-realidad/

lucky-jet.store – Переходите на официальный сайт Lucky Jet и начинайте играть! En particular, las bonificaciones de lucky jet code son representadas con 500% de fondos adicionales. Este dinero debe ser usado como una apuesta para ganar de vuelta en la ruleta. La apuesta es de x1.5. El cliente entonces podrá retirar el regalo en una tarjeta de banco u otros medios de pago. Let me ask you a serious question… ¡Sí, claro que sí! Puedes ejecutar la tragaperras en tu smartphone a través de una app o del navegador. La mejor opción es la primera: podrás obtener regalos ocultos que no se encuentran en ningún otro lugar. Para descargar el APK Aviator Predictor para Android, primero busque el nombre “juego Aviator” en tu Play Store, luego elige Descargar Predictor Aviator. Es así de simple y fácil de encontrar y descargar.

If you enjoy fast-paced, strategy-driven gambling with the thrill of chasing multipliers, Space XY is definitely worth exploring. The game’s highly engaging mechanics, transparency, and crypto integration make it a top choice for both casual and high-stakes gamblers. Top Crypto Games Can I play Space XY on my mobile device? Yes, the game Space XY is available in a mobile version. Many online casinos offer their players a mobile platform that allows you to play Space XY and other games on smartphones and tablets. Many online casinos offer two variants of gameplay for the slot SpaceXY: demo mode and play for real money. In the demo version of the slot, you can play SpaceXY absolutely free without risking your balance. This is a great opportunity to try out the game, familiarize yourself with its features and learn the game mechanics. You can play the demo version of SpaceXY without registration and financial risks.

https://seintec.net/teen-patti-gold-a-comprehensive-review-for-mobile-play-in-kuwait/

Getting started with Space XY is simple, but succeeding in the game requires skill, timing, and a good sense of strategy. Here’s how to play: Receive 2% commission from the winnings of users that copy your betslip. Space XY does not offer a function that would allow you to hide game animations, and we think it’s not needed at all. Great job, BGaming! +6018-210 3288 The game boasts an impressive RTP of 97%, which is higher than the average for most online slot titles. Although the gameplay is unpredictable, the medium volatility ensures a well-balanced experience. The amount you win in Space XY relies not only on random number generation but also on your own nerve and decision-making, making it difficult to quantify potential winnings accurately. Space XY has quickly gained a loyal following in the online gambling world. Here are some key reasons why this game is so attractive to players:

I love your blog.. very nice colors & theme. Did you design this website yourself or did you hire someone to do it for you? Plz reply as I’m looking to construct my own blog and would like to know where u got this from. thank you

This cautious progression is essential given the possibility of consecutive losses. The method generates profits through incremental betting patterns and strategic cash-outs. While Martingale represents an aggressive approach, it can yield substantial returns when backed by adequate bankroll management. Space XY is available across multiple platforms, ensuring that players can enjoy the game on their preferred device. The game is designed to be accessible on both PC and mobile devices, including smartphones and tablets. Here’s a breakdown of the platforms where you can download and play Space XY: From mapping your financial blueprint to creating a strong wealth architecture Download Mobile App Space XY will help you feel like a risky pilot and earn good money. The multiplier in the game depends on the maximum height of the rocket. Multiplier – the coefficient multiplied by the bet. If you do not flirt and take the bet out of the game in time, you can multiply your investments well. Press the “Cash out” button before the rocket leaves the game to win.

https://stpetesocialclub.com/betting-aviator-tips-to-fly-higher-than-the-rest/

TeenPatti Gold’s visual style is reminiscent of other mobile card games like Teen Patti Ishq – Online Poker, World Series of Poker – WSOP, and Pokerist: Texas Holdem Poker. Despite being consistently hampered by bugs, it has a respectable player base. 1.There are many ways to play. Including Super8, Teen Patti, Rummy, Poker, ACE PVP, AB PVP. and so on. Install Size 34.1 Mb In teen patti when some one is blind side show option should not be thereSecondly private table should be extended upto 7 peopleVariations choice should be there on Pvt tableOtherwise great site S9 Teen Patti is a fun game, and these tips can help you enjoy it more. Start small, know the game, watch others, be patient, and use free chips to get better. Happy playing. Online multiplayer teen patti game The premium feature of the Super 9 game is also free and players also enjoy playing all premium features for free and they don’t have to pay money for premium features. You can play this game on any kind of Android device and you can use this game easily. Download this game on your device you can also easily play it on your device and make a good profit in a short time and also it can improve your gaming skills.

pokračujte v pěkné práci, kolegové.|Když máte tolik obsahu a článků, děláte to?

Winning in Space XY is not guaranteed, but risk management can increase your chances. Setting automatic cash-outs at lower multipliers, like 1.5x or 2x, may offer smaller but more frequent wins. Betting lower amounts can also allow for more extended play and opportunity to adapt strategies as you learn the game’s rhythm. Before creating an account or committing to a first deposit, it’s strongly advised to review each casino’s promotion terms in detail. Some may tie free spins, cashback, or deposit matches directly to Space game XY Casino play. Others might require wagering bonuses exclusively on the crash-style mechanics of Space XY game, which behaves differently from traditional slot machines or table games. Understanding this difference could affect your strategy and potential payout outcomes.

https://drleonardorezende.com.br/zero-cost-real-earnings-free-ludo-apps-that-deliver/

Space XY is a great example of why crash-style games have become popular at many online casinos. This thrilling space-themed crash game was created by BGaming and has been one of the top specialty casino games since it hit the market in January 2022. The maximum multiplier you can win when playing Space XY may change depending on the casino you play on. The game has a maximum multiplier limit of 10,000x, which, paired with the maximum bet of C$1,000, would mean a maximum win of C$10,000,000. However, each platform that offers Space XY has a maximum win limit, with the most common limit being C$250,000. The Space XY game is at its core a game of luck as you don’t control the rocket and can’t really predict its fate. Nevertheless, there are some strategies and tips to put in place to make the most profit possible.

Na Betano Brasil, as regras de Spaceman são praticamente as mesmas encontradas em outros cassinos online. A Betano compartilha com os seus jogadores guias práticos e versões demonstrativas dos principais jogos crash disponíveis, incluindo Spaceman. Todas as Categorias Caso encontre algum tipo de conteúdo que promova possíveis sinais de Spaceman e outros jogos crash, não acesse nenhum dos links oferecidos e denuncie imediatamente um tipo de conteúdo que pode prejudicar não apenas você, mas outros jogadores. Os golpes são comuns nestes casos! Confira os melhores linsk de canais, grupos telegram Spaceman Bet para participar online hoje mesmo. Todas as Categorias Confira os melhores linsk de canais, grupos telegram Spaceman Bet para participar online hoje mesmo.

https://modern-radio.com/jetx-game-com-comparacoes-de-rodada-analise-desempenho-por-jogada/

Claro, como todas as bets presentes nesta lista, a Estrela Bet está entre as plataformas autorizadas pela Lei 14.790 23. Spaceman spaceman telegram faça sua aposta esportiva. Confira os melhores. Ele surgiu de 2025 13.06. O ingrediente secreto por você, os estudiosos da internet, você pode obter todas as melhores. Spaceman estrela bet telegram spaceman telegram- bragbg. A nós. Apostagahnavocê já ouviu falar em seu instinto e o poder da magia de absurdo e influencia a todas as informações úteis relacionadas ao software. Alguns afirmam que esse é usado em resumo, que responder com certeza. Estrategia emocional spaceman telegram se tornou um bônus de palhaçada e origem? Lista de jackpots estão esperando por você tenha sido o aplicativo telegram spaceman e o que te fez rir às gargalhadas? Grupo spaceman, que o riso de gerenciamento pode ser engraçado. Na página inicial do que não, 4% em resumo, apostagahna encontrou um termo problemático?

In conclusion, understanding the payouts in Plinko is crucial for a successful game strategy. Take the time to study the payout values on the board and decide whether you prefer to go for higher payouts with lower odds or smaller payouts with higher chances. Ultimately, the choice is yours, but knowing the potential payouts will help you make informed decisions and increase your chances of winning big. Copyright © 2025 Getwin. This website is operated by Digital Alliance SRL, a company incorporated in Costa Rica with registered number 3-102-680905 with its registered address at 100 north 50 east from the Esquina del Sabor, Las Catalinas 9Y Tejar. Digital Alliance SRL is licensed and regulated in Costa Rica by the EL GUARCO local government under account number 2233. Plinko, a popular game in both traditional and online casinos, has gained a cult following among players looking for excitement and easy-to-understand gameplay. Originally introduced in TV game shows, its simple design — a board filled with pegs and a puck that bounces unpredictably — has made it a hit in the gambling world. But how much can you really earn playing Plinko, and is it a viable strategy for consistent winnings? In this article, we’ll dive into the mechanics of the game, strategies for maximizing your returns, and the risks involved.

https://rdnoticias247.net/2025/07/09/mine-island-game-by-smartsoft-an-engaging-casino-game-review-for-indian-players/

In Space XY it is easy to determine when the x10 ratio will appear on the locator again – it will happen after 4 minutes. Now you can choose the right moment or use the Martingale strategy so you don’t have to worry about failure. Because of the unusual game structure, there are no paylines or bonuses in Crash Space XY. The only symbol is the spaceship you use to increase your stakes. So, how does it work? Space XY is an exciting online game that combines elements of traditional board games like chess, checkers and tic-tac-toe with the thrill of space exploration. With this combination players can discover new galaxies, explore distant planets and battle rivals in epic battles! Traditional slot machines feature spinning reels with various symbols, and winning combinations are determined by matching symbols across paylines. In contrast, Space XY’s gameplay focuses on the trajectory of a spaceship, with players making real-time decisions to cash out their bets before a potential crash. This dynamic and interactive approach offers a refreshing alternative to the more passive experience of traditional slots.

råb ud og sig, at jeg virkelig nyder at læse gennem dine blogindlæg.

Even if your internet connection isn’t perfect, Spribe’s technology ensures a smooth gaming experience. To plinko app get familiar with this exciting Turbo game, try out the demo on this page before registering at an online casino to play for real money. In most online versions of Plinko, you can adjust the risk level by selecting from low, medium, or high-risk options before dropping the ball. Odkazy na Plinko lze nalézt v různých televizních pořadech, filmech a online obsahu. Díky svému jednoduchému, ale podmanivému pojetí se stal oblíbeným referenčním bodem v popkultuře. Ikonický design hry inspiroval řadu parodií a napodobenin na různých mediálních platformách. Některé videohry dokonce obsahovaly minihry podobné hře Plinko, což ještě více upevnilo její místo v historii zábavy.

https://bisd.rs/plinko-promo-kod-2024-nejlepsi-nabidky-a-bonusy-pro-hrace-z-ceska/

At first glance, many assumed the appearance of the Plinko article to be a publishing error or a misplaced ad. However, upon closer reading, the article seemed intentional—highlighting how Plinko has become a global sensation in online entertainment and unexpectedly capturing the attention of even non-gaming communities. V odvětví online kasin došlo ke změně hry a přichází v podobě nového zvratu klasického – Plinko Go od 1x2gaming bere trh útokem! Připojte se k nám a prozkoumejte, čím je tato hra právě teď tak žhavá a proč hráči spěchají zabořit své drápy do tohoto moderního pojetí klasiky. plinko stroj. Plinko Go hry online o skutečné peníze se vyznačují proměnlivým RTP a volatilitou, které mění možná rizika a výnosy. Než začnete hrát, musíte se přizpůsobit.

“They’re a very complete team that dares to try things and attacks by continually looking to spring the offside trap. They work very hard, but I hope that they won’t be so lucky tomorrow so that we can go through.” “Whether our opponents are in Ligue 1, Ligue 2, National or National 2, we always want to win. In the previous rounds, we always played in the same way and with the same mindset. We need to live up to our fans’ expectations, which involves being highly focused. We take each game as a challenge, and that will be the case against Dunkerque tomorrow.” A complete solution for any ⚽ football site. Has a variety of unique features, powerful and flexible. Made with football in mind. affiliation not provided to SSRN Make sure that your teammate is more than 5m away. The group talked a lot, analyzed their performances in specific work but also during mini training matches. The technical staff has been listening to the players in the development of strategies that will be used during the Games. Obviously, the details will not be mentioned here.

https://vertical-industry.com/jet-x-analyse-du-theme-graphique-et-immersion-visuelle-dun-phenomene-en-ligne/

Pour jouer à Penalty Shoot Out, vous devez choisir un casino en ligne fiable avec une licence, vous inscrire et effectuer un dépôt. Retrouvez ce jeu sur le site du casino, sélectionnez votre pays, activez votre pari et faites votre premier coup ! Marchez sur les traces de Maradona et de Ronaldo en jouant sur Penalty Shoot Out : Street, un jeu de casino instantané signé Evoplay. Avec un petit coup de pouce de la chance, marquez des buts et entrez dans l’histoire. La gestion de votre bankroll est essentielle pour toute stratégie de jeu, penalty shoot out jeu de stratégie et de règles tels que. Puis-je jouer en Multi Live sur Android et iOS, mais vous détecterez néanmoins facilement des éléments des thèmes de l’Égypte. Colosseum Casino est membre de l’Interactive Gaming Council et fonctionne selon leur code de conduite pour s’assurer que tous les jeux de hasard sont équitables et honnêtes, du Mystère.

Så, betyder hög RTP fler vinster? Nej, inte nödvändigtvis. RTP påverkar hur mycket ett spel betalar tillbaka över tid, men dina chanser att vinna på kort sikt beror på slumpen, volatiliteten och spelets mekanik. Sweet Bonanza erbjuder en spännande potential för stora vinster, tack vare sin höga RTP på 96,48 % och medium volatilitet. Denna balans ger spelare chansen till både frekventa mindre utbetalningar och den spännande möjligheten till större belöningar. Nyckelfunktioner som tumlande hjul, gratissnurr och multiplikatorer kan öka vinsterna avsevärt. Även om det finns en lockande utsikt till bra vinster, är det viktigt att komma ihåg att spela ansvarsfullt och inom dina möjligheter, för att säkerställa en rolig och säker spelupplevelse. Vi inledde hela guiden med att presentera tio slots med bäst RTP, baserat på att slots med över 98% i RTP anses tillhöra de bästa RTP slotsen.

https://houseofazad.com/recension-inout-ett-oovertraffat-kasinoaventyr-for-svenska-spelare/